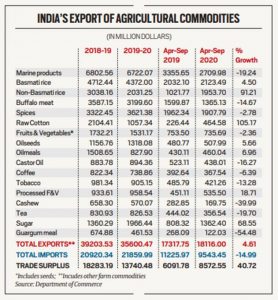

Commodity-wise foreign trade data from the department of commerce shows exports of farm goods from India during April-September at $18.12 billion, 4.6% higher than the $17.32 billion for the first half of 2019-20.

India’s agricultural exports are up 4.6% year-on-year in dollar terms during April-September. This comes even as the country’s overall merchandise exports for the same period have registered a 21.2% annual decline. It also mirrors a larger trend — of the farm sector doing reasonably well amid an economy that, according to the Reserve Bank of India, is likely to contract by 9.5% in 2020-21 (April-March).

Commodity-wise foreign trade data from the department of commerce shows exports of farm goods from India during April-September at $18.12 billion, 4.6% higher than the $17.32 billion for the first half of 2019-20.

Rice on top

The star performer has been rice, with the value of shipments increasing by well over a third to $4.08 billion in April-September. The growth has come more from the non-basmati rather than basmati segment (see table). Total exports this fiscal are expected to surpass the previous record of 12.7 million tonnes ($7.8 billion) achieved in 2017-18.

The value of rice shipments increased by well over a third to $4.08 billion in April-September. (Representational Image)

India’s agricultural exports are up 4.6% year-on-year in dollar terms during April-September. This comes even as the country’s overall merchandise exports for the same period have registered a 21.2% annual decline. It also mirrors a larger trend — of the farm sector doing reasonably well amid an economy that, according to the Reserve Bank of India, is likely to contract by 9.5% in 2020-21 (April-March).

Commodity-wise foreign trade data from the department of commerce shows exports of farm goods from India during April-September at $18.12 billion, 4.6% higher than the $17.32 billion for the first half of 2019-20.

Rice on top

The star performer has been rice, with the value of shipments increasing by well over a third to $4.08 billion in April-September. The growth has come more from the non-basmati rather than basmati segment (see table). Total exports this fiscal are expected to surpass the previous record of 12.7 million tonnes ($7.8 billion) achieved in 2017-18.

A third commodity whose exports have done well this year, and the prospects also look good, is cotton. In the 2019-20 season (October-September), India exported 50 lakh bales of the natural fibre, compared to 42 lakh bales in the preceding year. There are projections by the trade of the new cotton year’s exports hitting 70 lakh bales — the highest since 117 lakh bales in 2013-14. The driving factors here are the depreciation in the rupee and global prices (of the benchmark Cotlook ‘A’ Index) recovering to around 77 cents per pound, from their early-April lows of below 60 cents.

The broader trend

The general story in most agri-commodities is that world prices, which were hardening in the months just before the pandemic and then crashed with lockdown measures imposed by most countries, have since resumed their earlier trajectory.

This is captured by the UN Food and Agriculture Organization’s (FAO) Food Price Index (base year: 2014-16=100), which rose from 93.3 points in September 2019 to a 61-month-high of 102.5 in January 2020. Subsequently, it collapsed to a four-year-low of 91 points by May. But since then, it has risen every single month to touch 100.9 points in October (see line graph).

The recovery in global prices — courtesy a combination of demand revival from unlockdowns (opposite to what happened in April-May), continuing supply chain disruptions (including from a shortage of shipping containers), Chinese stockpiling (in anticipation of a fresh corona outbreak during the winter) and dry weather in producer countries such as Thailand, Argentina, Brazil and Ukraine — isn’t bad news for Indian farmers.

India’s agricultural exports peaked at $43.25 billion in 2013-14, before plunging to $ 32.81 billion in 2015-16. This period also saw the FAO index dip from an average of 119.1 to 90 points. Farm exports recovered somewhat to $39.2 billion by 2018-19, but declined to $ 35.6 billion in the following fiscal. In the current fiscal, they have grown 4.6% even as imports are down 15%. As a result, the overall agri-trade surplus has widened from $ 6.1 billion in April-September 2019 to $8.6 billion in April-September 2020.

Courtesy Indian EXpress